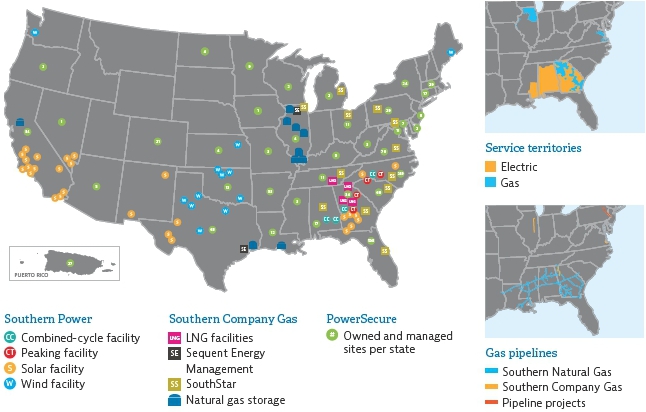

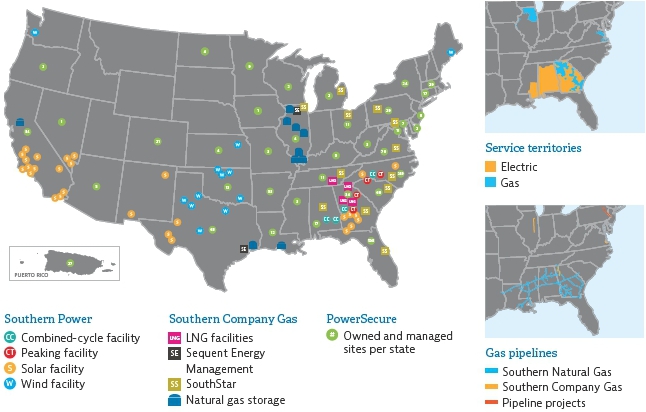

| The Operations, Environmental and Safety Committee’s duties and responsibilities include the following: ► | Oversee information, activities and events relative to significant operations of the Southern Company system including nuclear and other power generation facilities, electric transmission and distribution, natural gas distribution and storage, fuel and information technology initiatives. | ► | Oversee business strategies designed to address the long-term reduction of carbon emissions and related risks and opportunities across the Company. | ► | Oversee significant environmental and safety regulation, policy and operational matters. | | matters, including net zero carbon strategies. ► | Oversee the Southern Company system’s management of significant construction projects. | ► | Provide input to the Compensation and Management Succession Committee on the key operational goals and metrics for the annual short-term incentive compensation program. The Board has determined that each member of the Operations, Environmental and Safety Committee is independent. | | | | |

TheTable of Contents

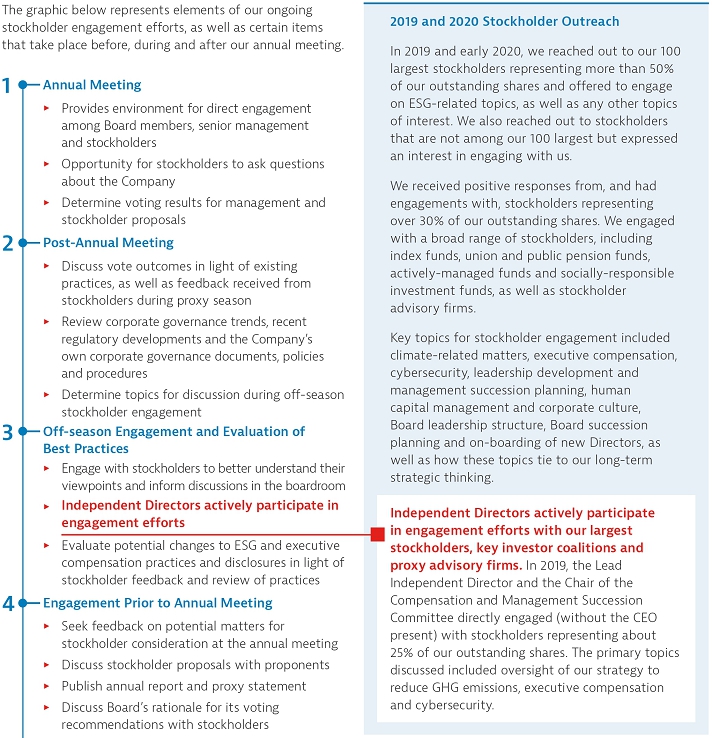

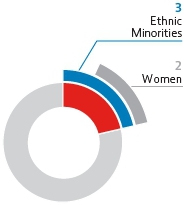

Corporate Governance at Southern Company

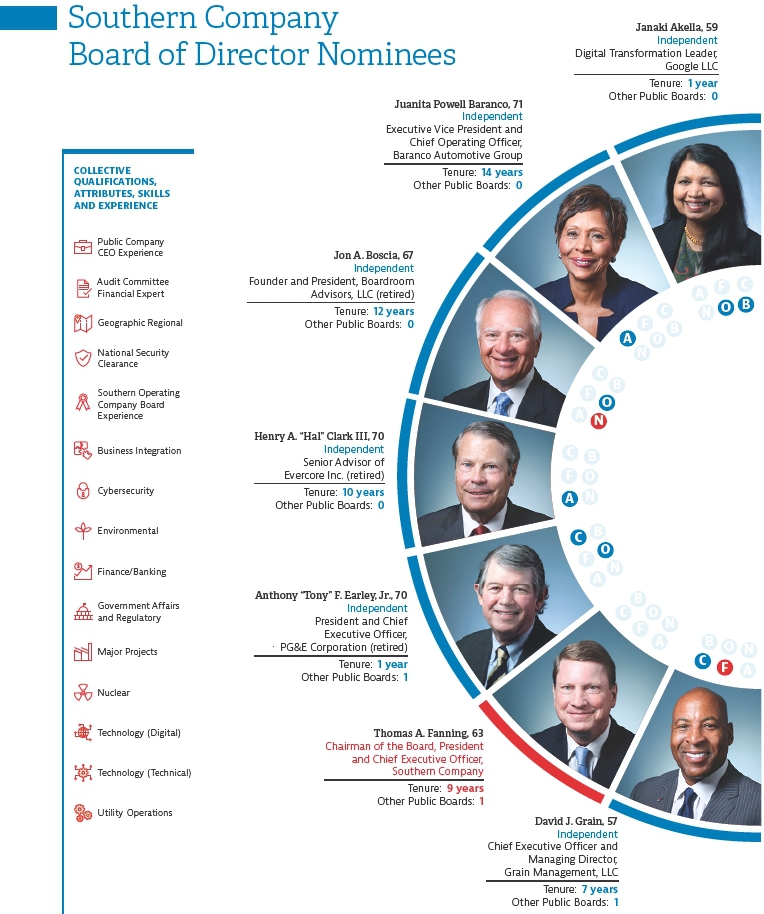

33 Board Composition and Structure Board Diversity, Board Refreshment and Board Succession Planning Our commitment to diversity and inclusion begins with the Board. Our Board believes a diverse variety of viewpoints contribute to a more effective decision-making process and helps drive long-term value. Our Board has determinedincluded a female member every year since 1984 – nearly four full decades. While our Corporate Governance Guidelines do not prescribe diversity standards, the Guidelines provide that each memberthe Board as a whole should be diverse. The Guidelines also include “Rooney Rule” language confirming the Board’s commitment to actively seeking out women and minority candidates to include in the pool from which Board nominees are chosen. The Nominating, Governance and Corporate Responsibility Committee assesses the effectiveness of its efforts at pursuing diversity through its regular evaluations of the Operations, Environmental and Safety Committee is independent.

| | Board Composition and Structure |

Board RefreshmentBoard’s composition.

The Nominating, Governance and Corporate Responsibility Committee regularly considerscontinues to focus on Board refreshment to align the Board’s long-term makeupcomposition with the Company’s long-term strategy and to effect meaningful Board succession planning. It has an evergreen Board search process in place and has engaged a nationally-recognized Board search firm to assist in the identification of our Board and how the members of our Board will change over time, including frequent consideration of potential Boardqualified candidates. In 2019, | ► | The Nominating, Governance and Corporate Responsibility Committee regularly evaluates the expertise and needs of the Board to determine the Board’s membership and size. | | ► | As part of this evaluation, the Nominating, Governance and Corporate Responsibility Committee considers aspects of diversity, such as diversity of race, gender and ethnicity. | | ► | The Nominating, Governance and Corporate Responsibility Committee also considers diversity of age, education, industry, business background and experience in the selection of candidates to serve on the Board. |

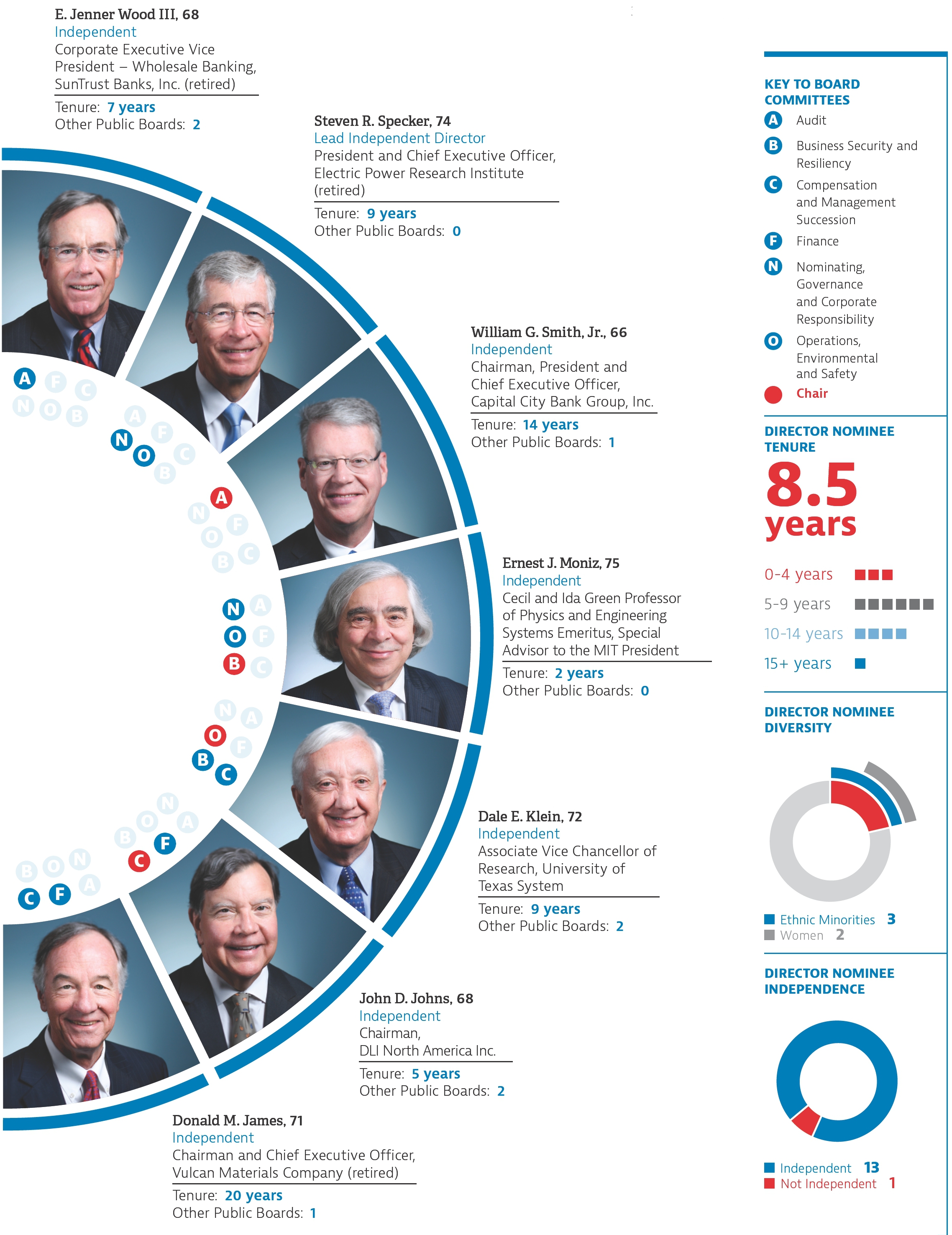

Since March 2018, we have added four new independent Directors to the Board, updatedwith two of those Directors being women of color. Over the Corporate Governance Guidelines to confirm its belief insame period of time, four Directors have retired. Effective at the importance of regular Board refreshment.annual meeting, two additional Directors will retire. The Board aims to strike a balance between the knowledge that comes from longer-term service on the Board and the new experience and ideas that can come from adding Directors to the Board.Board. The Board believes the average tenure of the Director nominees of approximately 8.5 years reflects the balance the Board seeks between different perspectives brought by longer-serving Directors and new Directors. DIRECTOR NOMINEE TENURE | 8.5

years |  |

The Nominating, Governance and Corporate Responsibility Committee continues to focus on Board refreshment to align the Board’s long-term composition with the Company’s long-term strategy and to effect meaningful Board succession planning. The Nominating, Governance and Corporate Responsibility Committee has an evergreen Board search process in place and has engaged a nationally-recognized Board search firm to assist in the identification of qualified candidates.

During 2019, the Nominating, Governance and Corporate Responsibility Committee undertook a review of the collective qualifications, skills, attributes and experience that it desires on the Board and updated the Board composition analysis and associated definitions. The aim of the review and update was to consider the qualifications, skills, attributes and experiences that the Board believes are aligned with oversight of long-term strategy and related risks and opportunities.

Since March 2018, we have added three new independent Directors to the Board: Dr. Akella, Mr. Earley and Dr. Moniz. Over the same period of time, three directors have retired. Effective at the annual meeting, Mr. Thompson will retire from the Board.The Board aims to furthercontinue to refresh its membership in the coming year, with a particular focus on gender diverse Director candidatescandidates..

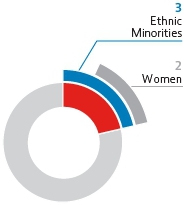

Southern Company 2020 Proxy StatementDirector Nominee Tenure | | 29Director Nominee Gender Diversity | | Director Nominee Ethnic/Racial Diversity | | | | | |  | |  | |  | | | Women | | Minorities |

Table of Contents Corporate Governance at Southern Company2021 Proxy Statement

34

Board Nomination Process Identifying Nominees for Election to the Board

The Nominating, Governance and Corporate Responsibility Committee, comprised entirely of independent Directors, is responsible for identifying, evaluating and recommending nominees for election to the Board. Final selection of the nominees for election to the Board is within the sole discretion of the Board. The Board believes that, as a whole, it should have collective qualifications, attributes, skills and experience beneficial to our Company and in line with our long-term strategic plansplans.. Colette D. Honorable was recommended by the Nominating, Governance and Corporate Responsibility Committee for election as independent Director and was elected to the Board effective October 1, 2020. Ms. Honorable was identified by the third-party Board search firm engaged by the Nominating, Governance and Corporate Responsibility Committee and several independent Directors. The following describes the selection process for new Directors. Board Succession Planning | | | | | Board

Succession

Planning | As it seeks potential candidates for Director, the Nominating, Governance and Corporate Responsibility Committee considers the qualifications, skills, attributes and experiences of the Board and identifies the skills and experiences of a candidate that would enhance the Board’s oversight of long-term strategy and related risks and opportunities. | | | Identification of

Candidates | | The Nominating, Governance and Corporate Responsibility Committee engages in an evergreen search process with the assistance of an independent search firm to identify qualified Director candidates based on the talent framework consistent with our leadership mission and aligned with our strategic imperatives that drive long-term value. The Nominating, Governance and Corporate Responsibility Committee also considers the following personal characteristics and qualifications: ►Highest degree of integrity and ethical standards ►Independence from management ►Ability to provide sound and informed judgment ►History of achievement that reflects superior standards ►Willingness to commit sufficient time ►Financial literacy ►Number of other board memberships ►Genuine interest in the Company and a recognition that, as a member of the Board, one is accountable to the stockholders of the Company, not to any particular interest group As part of its evaluation of Board composition, the Committee will consider aspects of diversity, such as diversity of race, gender and ethnicity. | | | Meeting with

Candidates | | Potential Director candidates are initially interviewed by our Chairman and CEO, Lead Independent Director and members of the Nominating, Governance and Corporate Responsibility Committee. If there is a collective agreement that the Nominating, Governance and Corporate Responsibility Committee would like to move forward with the candidate, all members of the Board are provided an opportunity to interview the Director candidate and provide feedback to the Committee. | | | Decision and

Nomination | | The Nominating, Governance and Corporate Responsibility Committee recommends, and the full Board approves, the Director candidate best qualified to serve the interests of the Company and its stockholders for nomination. | | | Election | | Stockholders consider the nominees and elect Directors at the annual meeting to serve one-year terms. The Board may also elect Directors on the recommendation of the Nominating, Governance and Corporate Responsibility Committee throughout the year, following the same process, when determined to be in the best interests of the Company and its stockholders. | |

30 | Southern Company 2020 Proxy Statement | | |

Table of Contents Corporate Governance at Southern Company

35 Proxy Access

Proxy access generally refers to the right of stockholders who meet certain ownership thresholds to nominate one or more Directors to the Board and have the nominees included in the Company’s proxy materials and on the Company’s proxy card. The following are the key terms of our proxy access By-Law. Stockholder Recommendation of Board Candidates | ► | The Nominating, Governance and Corporate Responsibility Committee considers potential board candidates recommended by stockholders. | | ► | Recommendations can be made by submitting the candidate’s information to our Corporate Secretary in writing at Southern Company, 30 Ivan Allen Jr. Boulevard NW, Atlanta, Georgia 30308. Stockholders should provide as much relevant information about the candidate as possible, including the candidate’s biographical information and qualifications to serve. | | ► | A stockholder recommended candidate is reviewed in the same manner as a candidate identified by the Nominating, Governance and Corporate Responsibility Committee. | | ► | For information about the direct nomination of directors for election by stockholders at an annual meeting as provided in the By-Laws, seepage 99113. |

Diversity of our Board

While our Corporate Governance Guidelines do not prescribe diversity standards, the Guidelines mandate that the Board as a whole should be diverse.Our Board believes that diversity is important, as a variety of viewpoints contribute to a more effective decision-making process.

►The Nominating, Governance and Corporate Responsibility Committee regularly evaluates the expertise and needs of the Board to determine the Board’s membership and size.

►As part of this evaluation, the Nominating, Governance and Corporate Responsibility Committee considers aspects of diversity, such as diversity of race, gender and ethnicity.

►The Nominating, Governance and Corporate Responsibility Committee also considers diversity of age, education, industry, business background and experience in the selection of candidates to serve on the Board.

| | DIRECTOR NOMINEE DIVERSITY

|

In 2019, the Board updated the Corporate Governance Guidelines to include “Rooney Rule” language confirming the Board is committed to actively seeking out diverse candidates and will include women and minority candidates in the pool from which Board nominees are chosen.

The Nominating, Governance and Corporate Responsibility Committee assesses the effectiveness of its efforts at pursuing diversity through its evaluations of the Board’s composition.

Southern Company 2020 Proxy Statement | 31 |

Table of Contents

Corporate Governance at Southern Company

Majority Voting for Directors and Director Resignation Policy We have a majority vote standard for Director elections, which requires that a nominee for Director in an uncontested election receive a majority of the votes cast at a stockholder meeting in order to be elected to the Board. The Board believes that the majority vote standard in uncontested Director elections strengthens the Director nomination process and enhances Director accountability. We also have a Director resignation policy, which requires any nominee for election as a Director to submit an irrevocable letter of resignation as a condition to being named as such nominee, which would be tendered in the event that nominee fails to receive the affirmative vote of a majority of the votes cast in an uncontested election at a meeting of stockholders. Such resignation would be considered by the Board, and the Board would be required to either accept or reject such resignation within 90 days from the certification of the election results. Board Independence Director Independence Standards

No Director will be deemed to be independent unless the Board affirmatively determines that the Director has no material relationship with the Company directly or as an officer, stockholder or partner of an organization that has a relationship with the Company. The Board has adopted categorical guidelines which provide that a Director will not be deemed to be independent if within the preceding three years: | ► | The Director was employed by the Company or the Director’s immediate family member was an executive officer of the Company. | | ► | The Director has received, or the Director’s immediate family member has received, during any 12-month period, direct compensation from the Company of more than $120,000, other than Director and committee fees. (Compensation received by an immediate family member for service as a non-executive employee of the Company need not be considered.) |

Table of Contents Southern Company 2021 Proxy Statement

36 | ► | The Director was affiliated with or employed by, or the Director’s immediate family member was affiliated with or employed in a professional capacity by, a present or former external auditor of the Company and personally worked on the Company’s audit. | | ► | The Director was employed, or the Director’s immediate family member was employed, as an executive officer of a company where any of the Company’s present executive officers at the same time served on that company’s compensation committee. | | ► | The Director is a current employee, or the Director’s immediate family member is a current executive officer, of a company that has made payments to, or received payments from, the Company for property or services in an amount which, in any year, exceeds the greater of $1,000,000 or 2% of that company’s consolidated gross revenues. | | ► | The Director or the Director’s spouse serves as an executive officer of a charitable organization to which the Company made discretionary contributions which, in any year, exceeds the greater of $1,000,000 or 2% of the organization’s consolidated gross revenues. |

These guidelines are in compliance with the NYSE corporate governance rules within its listing standards. Director Independence Review Process

At least annually, the Board receives a report on all commercial, consulting, legal, accounting, charitable or other business relationships that a Director or the Director’s immediate family members have with the Company and its subsidiaries. This report includes all ordinary course transactions with entities with which the Directors are associated. | ► | The Board determined that the Company and its subsidiaries followed our procurement policies and procedures, that the amounts reported were well under the thresholds contained in the Director independence requirements and that no Director had a direct or indirect material interest in the transactions included in the report. | | ► | The Board reviewed all contributions made by the Company and its subsidiaries to charitable organizations with which the Directors are associated. The Board determined that the contributions were consistent with other contributions by the Company and its subsidiaries to charitable organizations and none were approved outside the Company’s normal procedures. |

32 | Southern Company 2020 Proxy Statement |

Table of Contents

Corporate Governance at Southern Company

| ► | In determining Director independence, the Board considers transactions, if any, identified in the report discussed above that affect Director independence, including any transactions in which the amounts reported were above the threshold contained in the Director independence requirements and in which a Director had a direct or indirect material interest. No such transactions were identified and, as a result, no such transactions were considered by the Board. | | ► | In making its determination, the Board considered the fact that one of the Company’s Directors, Ms. Honorable, is a partner at Reed Smith LLP, which provides legal services to the Company and its affiliates. The Board also considered that, in the ordinary course of the Southern Company system’s business, electricity and natural gas are provided to some Directors and entities with which the Directors are associated on the same terms and conditions as provided to other customers of the Southern Company system. |

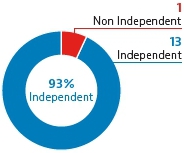

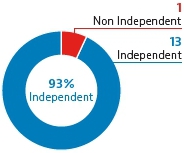

As a result of its review process, the Board affirmatively determined that 1312 of its 1413 nominees for Director are independent.Mr. Thompson,Boscia and Dr. Specker, who isare retiring from the Board at the annual meeting, isand Larry D. Thompson, who retired at the 2020 annual meeting, are also independent. The only member of the Board that is not independent is Mr. Fanning, Chairman, President and CEO of the Company.

| Independent Director Nominees | | Director Nominee Independence | ►Janaki Akella ►Juanita Powell Baranco ►Jon A. Boscia

►Henry A. Clark III ►Anthony F. Earley, Jr. ►David J. Grain ►Colette D. Honorable | ►John D. Johns ►Dale E. Klein ►Ernest J. Moniz ►William G. Smith, Jr. ►Steven R. Specker ►E. Jenner Wood III

| |

DIRECTOR NOMINEE INDEPENDENCEIndependent

|

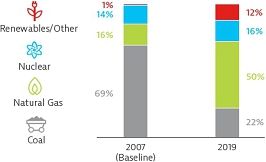

Table of Contents Corporate Governance at Southern Company

37 Board Leadership Structure Our Corporate Governance Guidelines and our By-Laws allow the independent Directors to determine the appropriate Board leadership structure for Southern Company, including the flexibility to split or combine the Chairman and CEO responsibilities. The independent Directors annually review our Board leadership structure to determine the structure that is in the best interestinterests of Southernthe Company and its stockholders. The Board continues to believebelieves that presently its current leadership structure, which has a combined role of Chairman and CEO counterbalanced by a strong independent Board led by an empowered Lead Independent Director, active and engaged independent Directors and fully-independent Board committees chaired by independent Directors, provides the optimal balance between independent oversight of management and unified leadership. The Board believes this leadership structure is most suitable for us at this time and is in the best interestinterests of ourthe Company and its stockholders. | ► | The combined role of Chairman and CEO is held by Tom Fanning, who is the Director most familiar with our business and industry including(including the regulatory structure and other industry-specific matters, as well as beingmatters) and is most capable of effectively identifying strategic priorities and leading discussion and execution of strategy. During his tenure as Chairman and CEO, Mr. Fanning has been instrumental in driving forward Southern Company’s strategic priorities, including Southern Company’s climate strategy and the progression to our long-term greenhouse gas emissions reduction goal, announced in 2020, of net zero emissions by 2050. | | ► | The Board believes that the combined role of Chairman and CEO promotes the development and execution of our strategy. Independent Directors and management have different perspectives and roles in strategy development. The CEO brings Company-specific experience and expertise, while our independent Directors bring experience, oversight and expertise from outside the Company and its industry. At the same time, several of our independent Directors have deep experience within our industry, and all of our independent Directors receive comprehensive industry information from diverse sources, both internal and external, to best position them to oversee the Company’s strategy and key risks. | | ► | The Board believes that the combined role of Chairman and CEO promotes the development and execution of our strategy and facilitates the flow of information between management and the Board, which is essential to effective corporate governance. For example, the Board recognizes the importance of presenting the Board with robust and comprehensive meeting agendas and information. As a result, a key element of the Lead Independent Director’s role is working with the Chairman to set the agenda for Board meetings and reviewing and approving the meeting materials. |

Southern Company 2020 Proxy Statement | 33 |

As the Board looks toward the future and evaluates the Company’s leadership, risks, opportunities and long-term strategic priorities, the Board is also evaluating other governance matters, such as the size of the Board and the Board’s skills makeup and diversity. While the Board annually reviews its leadership structure, the Board will undertake a more comprehensive review of its leadership structure in conjunction with a CEO transition. The Nominating, Governance and Corporate Responsibility Committee will help lead our Board in this important evaluation, which will include consideration of an independent board chair. The Nominating, Governance and Corporate Responsibility Committee will perform a comprehensive review and analysis of current and emerging best practices with respect to board leadership structure. As part of the process, we will (among other things) reach out to stockholders, solicit feedback on board leadership structure and share that feedback with the Nominating, Governance and Corporate Responsibility Committee. We also anticipate that the Chair of the Nominating, Governance and Corporate Responsibility Committee will engage directly with key stockholders to solicit feedback on board leadership structure. The Nominating, Governance and Corporate Responsibility Committee also will consider the role of the Board’s leadership in helping the Company achieve its long-term strategic priorities, including the Company’s decarbonization efforts to meet its long-term GHG emission reduction goal of net zero by 2050, the Company’s fleet transition plans to meet both the interim goal and the 2050 goal and the Company’s enterprise-wide capital allocation plans. After completing its review, the Nominating, Governance and Corporate Responsibility Committee will present its recommendations to our independent Directors, who will determine the Board leadership structure that is most suitable for us and is in the best interests of the Company and its stockholders at the time of a CEO succession.

Table of Contents Corporate Governance at Southern Company2021 Proxy Statement

38

| Role of the Lead Independent Director | DR. STEVEN R. SPECKER

The independent Directors are committed to providing independent oversight of Southern’s long-term strategy and significant risks on behalf of all stockholders.

| |

The Lead Independent Director role at Southern is elected by the independent Directors of the Board. Dr. Specker was elected by the independent Directors in May 2018 to serve as Lead Independent Director.

The Lead Independent Director hasrobust, with the following key authorities and responsibilities:

| | ► | Working with the Chairman to set the agenda for Board meetings | | ► | Approving the agenda (with the ability to add agenda items) and schedule for Board meetings to provide that there is sufficient time for discussion of all agenda items | | ► | Approving information sent to the Board | | ► | Chairing executive sessions of the non-management Directors, held atwhich are included on the agenda of every regular board meeting, and having the ability to call an executive session | | ► | Chairing Board meetings in the absence of the Chairman | | ► | Meeting regularly with the Chairman | | ► | Acting as the principal liaison between the Chairman and the non-management Directors (although every Director has direct and complete access to the Chairman at any time) | | ► | Serving as the primary contact Director for stockholders and other interested parties | | ► | Communicating any sensitive issues to the Directors | | ► | Overseeing the independent Directors’ performance evaluation of the Chairman, in conjunction with the chair of the Compensation and Management Succession Committee | The Lead Independent Director is elected by the independent Directors of the Board to serve in the role for a period of generally two to three years. The Board’s succession planning process includes the regular review of the skills, qualifications, attributes and experiences of the independent Directors to identify potential future candidates for the Lead Independent Director role. Dr. Specker was elected by the independent Directors in May 2018 to serve as Lead Independent Director. Following Dr. Specker’s retirement at the annual meeting, the independent Directors will elect a new Lead Independent Director consistent with its long-term Board succession planning process. |

Role of the Independent Directors

The Board has strong, independent Directors that provide additional independent leadership to the Board and effective oversight of management. All members of our Board other than the Chairman and CEO, or 14 of our 15 currently serving Directors, are independent.

The independent Directors are free to raise subjects at a Board meeting that are not on the agenda for that meeting. TheAn executive session, which allows the independent Directors to meet in executive session without the Chairman and CEO present, atis included on the agenda of every regular board meeting. All of the Board’s six standing committees are comprised solely of independent Directors, and independent Directors chair all of these committees. Each Board committee has a designated member of senior management, other than the Chairman and CEO, that works with the independent Director that chairs that committee to develop the committee’s agenda for each meeting. The independent Director that chairs each committee reviews and approves the agenda and materials to be covered at the upcoming meeting. The independent Directors are free to raise subjects at a committee meeting that are not on the agenda for that meeting. Each Board committee meets inAn executive session atis included on the agenda of every regular committee meeting. 34 | Southern Company 2020 Proxy Statement |

Table of Contents

Corporate Governance at Southern Company

The independent Directors evaluate the performance of the Chairman and CEO at least annually. The Lead Independent Director, in conjunction with the chair of the Compensation and Management Succession Committee, is responsible for overseeing the evaluation process. Input on the Chairman and CEO’s performance is sought from all of the independent Directors. The Lead Independent Director facilitates a robust discussion of the evaluation results with the independent Directors while meeting in executive session. The Lead Independent Director and the chair of the Compensation and Management Succession Committee together discuss the evaluation with the Chairman and CEO. The evaluation is used by the Compensation and Management Succession Committee to determine the compensation to be recommended for ratification by the independent Directors.

Table of Contents Corporate Governance at Southern Company

39 Meetings and Attendance The Board met 8 times in 2019. All of our Directors attended at least 75% of applicable Board and committee meetings in 2019. Our Directors are engaged, as demonstrated by the average Director attendance at all applicable Board and committee meetings in 2019 of 96%.

All Director nominees are expected to attend the annual meeting of stockholders. All nominees for Director at the 2019 annual meeting were in attendance at the meeting.

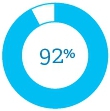

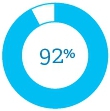

The Board met nine times in 2020. All of our Directors attended at least 75% of applicable Board and committee meetings in 2020. Our Directors are engaged, as demonstrated by the average Director attendance at all applicable Board and committee meetings in 2020 of 98%. All Director nominees are expected to participate in the annual meeting of stockholders. All nominees for Director at the 2020 annual meeting attended the virtual annual meeting. |

| ENGAGED DIRECTORSEngaged Directors |   |

Southern CompanyAverage 2020 Proxy Statement | 35 |

Board

Table of Contents

Corporate Governance at Southern Company

| | Board and Committee ResponsibilitiesMeeting

Attendance |

Board Continuing Education Directors are encouraged to participate in continuous learning in an effort to promote the investment in knowledge on matters relevant to the Company. On a quarterly basis, we provide our Directors with suggested educational courses on topics including emerging governance issues, compliance and ethics matters, financial and risk oversight and industry-specific subjects. To facilitate ongoing education by our Directors, we pay the costs for registration and tuition and related travel and lodging expenses. Board and Committee Responsibilities Board Risk Oversight The Board and its committees have both general and specific risk oversight responsibilities. The Board has broad responsibility to provide oversight of significant risks primarily through direct engagement with management and through delegation of ongoing risk oversight responsibilities to the committees. Any risk oversight that is not allocated to a committee remains with the Board. At least annually, the Board reviews our risk profile to ensure that oversight of each risk is properly designated to an appropriate committee or the full Board.The charters of the committees and the checklist of agenda items for each committee define the areas of risk for which each committee is responsible for providing ongoing oversight. | | | | | | | Audit Committee | | ►Reviews risks and associated risk management activities related to financial reporting and ethics-ethics and compliance-related matters. ►Reviews the adequacy of the risk oversight process and documentation that appropriate enterprise risk management and oversight are occurring. The documentation includes a report that tracks which significant risk reviews have occurred and the committee(s) reviewing such risks. In addition, an overview is provided at least annually of the risk assessment and profile process conducted by Company management. ►Receives regular updates from Internal Auditing and quarterly updates as part of the disclosure controls process. | | | Business Security and Resiliency Committee | | ►Reviews risks and associated risk management activities related to cybersecurity, physical security, operational resiliency and technological developments and the response to incidents with respect thereto. ►Reviews the adequacy of processes and procedures to protect critical cyber and physical assets and resiliency of ongoing operations. | | | Compensation and Management Succession Committee | | ►Reviews risks and associated risk management activities related to workforce issues.human capital. ►Reviews the assessment of risks associated with the Company’s employee compensation policies and practices, particularly performance-based compensation, as they relate to risk management practices and/or risk-taking incentives. The review is conducted at least annually and whenever significant changes to any business unit’s compensation practices are under consideration. | | | | | | |

Table of Contents Southern Company 2021 Proxy Statement

40 | | | | | | Finance Committee | | ►Reviews risks and associated risk management activities related to financial matters of the Company such as financial integrity, major capital investments, dividend policy, financing programs and financial and capital allocation strategies. | | | Nominating, Governance and Corporate Responsibility Committee | | ►Reviews risks and associated risk management activities related to the state and federal regulatory and legislative environment, stockholder activism and environmental, sustainability and corporate social responsibility. | | | Operations, Environmental and Safety Committee | | ►Reviews risks and associated risk management activities related to significant operations of the Southern Company system such as safety, system reliability, nuclear, gas and other operations, environmental regulation and policy, reducingnet zero carbon emissions,strategies, fuel cost and availability. | | | | | | | |

Each committee provides ongoing oversight for each of our most significant risks designated to it, reports to the Board on their oversight activities and elevates review of risk issues to the Board as appropriate. Each committee has a designated member of executive management as the primary responsible officer for providing information and updates related to the significant risks for that committee. These officers ensure that all significant risks identified in the risk profile we develop are regularly reviewed with the Board and/or the appropriate committee(s). 36 | Southern Company 2020 Proxy Statement |

TableThe Board’s oversight of Contents

Corporate Governancestrategy and risks includes oversight of key ESG matters, including climate, human capital, diversity, equity and inclusion, safety, cybersecurity and other matters. These matters are key to the long-term success of the Company and, accordingly, integrated into topics reviewed and discussed at Southern Companyeach Board meeting as well as the Board’s annual in-depth strategy session.

Southern Company has a robust enterprise risk management program that facilitates identification, communication and management of the most significant risks throughout the Company employing a formalized framework in which risk governance and oversight are largely embedded in existing organizational and control structures. As a part of the governance structure, the CFO serves as the Chief Risk Officer and is accountable to the CEO and the Board for ensuring that enterprise risk oversight and management processes are established and operating effectively. All Directors are actively involved in the risk oversight function, and we believe that our leadership structure supports the Board’s risk oversight responsibility. Each committee is chaired by an independent Director, and the Chairman and CEO does not serve on any committee. There is regular, open communication between management and the Directors. Cybersecurity Governance and Risk Oversight Cybersecurity is a critical component of our risk management program. The Board devotes significant time and attention to overseeing cyber and information security risk, and our strong approach to cybersecurity governance establishes oversight and accountability at every level of the enterprise. The Board’s Business Security and Resiliency Committee, comprised solely of independent Directors, is charged with oversight of risks related to cybersecurity and operational resiliency. The Business Security and Resiliency Committee includes directors with an understanding of cyber issues and with high-level security clearances. | ► | The Business Security and Resiliency Committee meets at every regular Board meeting and when needed in the event of a specific threat or emerging issue. The Chair of the Business Security and Resiliency Committee regularly reports out to the Board on key matters considered by the Committee. | | ► | The Business Security and Resiliency Committee routinely receives presentations on a range of topics, including the threat environment and vulnerability assessments, policies and practices, technology trends and regulatory developments. | | ► | The Chief Information Security Officer reports to the Business Security and Resiliency Committee at each committee meeting. |

Table of Contents Corporate Governance at Southern Company

41 We use a risk-based, “all threats” and “defense in depth” approach to identify, protect, detect, respond to and recover from cyber threats. Recognizing that no single technology, process or business control can effectively prevent or mitigate all risks, we employ multiple technologies, processes and controls, all working independently but as part of a cohesive strategy to minimize risk. This strategy is regularly tested through auditing, penetration testing and other exercises designed to assess effectiveness. | ► | Overall network security efforts are led by the Chief Information Security Officer and the Technology Security Organization. We utilize a 24/7 Security Operations Center, which facilitates real-time situational awareness across the cyber-threat environment, and a robust Insider Threat Protection Program and Fusion Center that leverages cross-function information sharing to assess insider threat activity. | | ► | We emphasize security and resiliency through business assurance capabilities and incident response plans designed to identify, evaluate and remediate incidents when they occur. We regularly review and update our plans, policies and technologies and conduct regular training exercises and crisis management preparedness activities to test their effectiveness. | | ► | We have implemented a security awareness program designed to educate and train employees at least annually, or more often as needed, about risks inherent to human interaction with information and operational technology. | | ► | Our cybersecurity program increasingly leverages intelligence sharing capabilities about emerging threats within the energy industry, across other industries, with specialized vendors and through public-private partnerships with government intelligence agencies. Such intelligence allows us to better detect and work to prevent emerging cyber threats before they materialize. |

| ► | The U.S. Department of Homeland Security has granted Certification for the Company’s cybersecurity risk management program under the Support Anti-Terrorism by Fostering Effective Technologies Act of 2002. | | ► | Our CEO co-chairs the Electricity Subsector Coordinating Council, which coordinates industry and federal government preparation for and response to potential national disasters and cyber-attacks. | | ► | Members of senior management have high-level security clearances to facilitate access to critical information, and we participate in pilot programs with industry and government to share additional information and strengthen cybersecurity and business resiliency. |

Succession Planning and Talent Development Valuing and developing our people is a strategic priority for our Company. To support this priority,we engage in detailed discussions around succession planning and talent development at all levels within our organization.organization. We have robust discussions and actions that occur throughout the year. The Board meets potential leaders at many levels across the organization through formal presentations and informal events on a regular basis. The Compensation and Management Succession Committee oversees the development and implementation of succession plans for senior leadership positions. | ► | The process starts with management undertaking a full internal review of performance and development of leaders across the organization. | | ► | Management presents and discusses with the Compensation and Management Succession Committee its evaluation and recommendations for senior leadership succession regularly throughout the year. | | ► | The Compensation and Management Succession Committee updates the Board on these discussions. |

The Compensation and Management Succession Committee is also regularly updated on key talent indicators for the overall workforce, including diversity, equity and inclusion, recruiting and development programs. The Board annually reviews succession plans for senior management and the CEO, including both a long-term succession plan and an emergency succession plan.To assist the Board, the CEO annually provides his assessment of senior leaders and their potential to succeed at key senior management positions. The evaluation is done in the context of the business strategy with a focus on risk management.

Table of Contents Southern Company 2021 Proxy Statement

42 Political Contributions and Lobbying-Related Oversight We believe that we have a responsibility to customers and stockholders to participate in the political process and, where appropriate, to make political contributions or expenditures (as defined by applicable law). The Company and its subsidiaries comply with all laws governing the use of corporate funds in connection with elections for public office. All political contributions or independent expenditures must be approved in advance. Engagement in legislative and regulatory proceedings at the federal, state and local levels of government is crucial to our success, and we devote substantial attention and resources to interaction with government officials as public policy is debated and laws and regulations are developed. We also work with trade associations and industry coalitions as part of our government relations activities. Southern’s political expenditures and lobbying-related activities are reviewed at least annually by the full Board. We provide on our website an overview of our policies and practices for political spending and annually disclose our political contributions. We also provide on our website an overview of our policies and practices for lobbying-related activities and annually disclose the trade associations and coalitions engaged in lobbying to which we make yearly contributions of $50,000 or more. The Center for Political Accountability Zicklin Index of Corporate Political Accountability and Disclosure ranked Southern in its top tier of S&P 500 companies for political transparency and accountability for 2019.

Southern Company 2020 Proxy Statement | 37 |

Table of ContentsBoard Governance Processes

Corporate Governance at Southern Company

| | Board Governance Processes |

Board and Committee Self-Evaluation Process The Board and each of its committees have a robust annual self-evaluation process. 1 | ● | | | | 1 | Board Evaluation | | | The Lead Independent Director, in conjunction with the Nominating, Governance and Corporate Responsibility Committee, oversees the annual self-assessment process on behalf of the Board. To help ensure a robust process, the Board has engaged an independent third party to facilitate its annual self-evaluation.

| | 2 | ●2 | Committee Evaluations | | | The charter of each committee of the Board also requires an annual performance evaluation, which traditionally is overseen by the chair of each committee. | | 3 | ●3 | Interviews and Discussion | | | The Board self-evaluation process involves completion of a written questionnaire by each Board member, followed by an interview of each Director conducted by an independent third party. The independent third party reviews the results of the evaluation process with the Lead Independent Director. The Lead Independent Director leads a discussion with the full Board to review the results of the self-evaluation and identify follow up items. The committee self-evaluation process involves a review and discussion for each committee. The process is led by the chair of each committee and is conducted in executive session. | | 4 | ●4 | Outcome | | | The objective is to allow the Directors to share their perspectives and consider adjustments or enhancements in response to the feedback. | | | | | |

As a result of the Board’s self-evaluation processes in recently years, the Board restructured meeting schedules to allow more time at many committee meetings throughout the year, evaluated Board materials to ensure an appropriate quantity of materials to facilitate a robust discussion and reviewed and updated agenda items to be considered at each meeting to use the Directors’ time more effectively.

Table of Contents Corporate Governance at Southern Company

43 Meetings of Non-Management Directors Non-managementAn executive session, which allows non-management Directors (our independent Directors) to meet in executive session without any members of the Company’s management present, atis included on the agenda of each regularly-scheduled Board meeting. These executive sessions promote an open discussion of matters in a manner that is independent of the Chairman and CEO. The Lead Independent Director chairs each of these executive sessions.

Certain Relationships and Related Transactions We have a robust system for identifying potential related person transactions. | ► | Our Audit Committee is responsible for overseeing our Code of Ethics, which includes policies relating to conflicts of interest. The Code of Ethics requires that all employees, officers and Directors avoid conflicts of interest, defined as situations where the person’s private interests conflict, or even appear to conflict, with the interests of the Company as a whole. | | ► | We conduct a review of our financial systems to identify potential conflicts of interest and related person transactions. | | ► | At least annually, each Director and executive officer completes a detailed questionnaire that asks about any business relationship that may give rise to a conflict of interest and all transactions in which the Company or one of its subsidiaries is involved and in which the executive officer, a Director or a related person has a direct or indirect material interest. | | ► | We have a Contract Manual and other formal written procurement policies and procedures that guide the purchase of goods and services, including requiring competitive bids for most transactions above $10,000 or approval based on documented business needs for sole sourcing arrangements. |

38 | Southern Company 2020 Proxy Statement |

Table of Contents

Corporate Governance at Southern Company

The approval and ratification of any related person transaction would be subject to these written policies and procedures which include: | ► | a determination of the need for the goods and services; | | ► | preparation and evaluation of requests for proposals by supply chain management; | | ► | the writing of contracts; | | ► | controls and guidance regarding the evaluation of the proposals; and | | ► | negotiation of contract terms and conditions. |

As appropriate, these contracts are also reviewed by individuals in the legal, accounting and/or risk management services departments prior to being approved by the responsible individual. The responsible individual will vary depending on the department requiring the goods and services, the dollar amount of the contract and the appropriate individual within that department who has the authority to approve a contract of the applicable dollar amount. We do not have a written policy pertaining solely to the approval or ratification of related person transactions. In 2019,2020, Ms. Alexia B. Borden, the daughter of Paul Bowers, an executive officer of the Company, was employed by Alabama Power as senior vice president and general counsel and received total compensation of $796,102.approximately $878,000. We do not have any other related person transactions that meet the requirements for disclosure in this proxy statement. In the ordinary course of the Southern Company system’s business, electricity and natural gas are provided to some Directors and entities with which the Directors are associated on the same terms and conditions as provided to other customers of the Southern Company system. Communicating with the Board We encourage stockholders or interested parties to communicate directly with the Board, the independent Directors or the individual Directors, including the Lead Independent Director. | ► | Communications may be sent to the Board as a whole, to the independent Directors or to specified Directors, including the Lead Independent Director, by regular mail or electronic mail. | | ► | Regular mail should be sent to our principal executive offices, to the attention of the Corporate Secretary, Southern Company, 30 Ivan Allen Jr. Boulevard NW, Atlanta, Georgia 30308. | | ► | Electronic mail should be directed tocorpgov@southerncompany.com. The electronic mail address also can be accessed from the Governance Inquiries link on the Corporate Governance page of our website atinvestor.southerncompany.com. |

With the exception of commercial solicitations, all communications directed to the Board or to specified Directors will be relayed to them. Southern Company 2020 Proxy Statement | 39 |

Table of Contents Southern Company 2021 Proxy Statement

44 Corporate Governance Website Information relating to our corporate governance is available on the Corporate Governance page of our website atinvestor.southerncompany.com. ►Board of Directors — Background and Experience ►Composition of Board Committees ►Board Committee Charters ►Corporate Governance Guidelines ►Link for on-line communication with Board of Directors ►Management Council — Background and Experience ►Executive Stock Ownership Requirements | ►Code of Ethics ►Restated Certificate of Incorporation ►Amended and Restated By-Laws (By-Laws) ►Securities and Exchange Commission (SEC) Filings ►Policies and Practices for Political Spending and Lobbying-Related Activities ►Anti-Hedging and Anti-Pledging Provision |

These documents also may be obtained by requesting a copy from the Corporate Secretary, Southern Company, BIN 803, 30 Ivan Allen Jr. Boulevard NW, Atlanta, Georgia 30308.  | | Director Compensation |

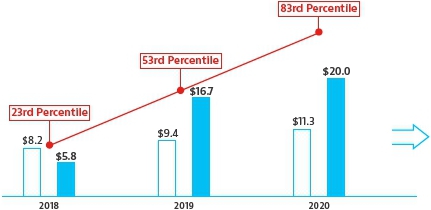

Director Compensation Only non-employee Directors of the Company are compensated for service on the Board. In October 2019, the Nominating, Governance and Corporate Responsibility Committee engaged Pay Governance to provide an independent assessment of the non-employee director compensation program to ensure continued alignment with comparable companies and sound governance practices. Pay Governance reported that the Company’s program provides total direct compensation (retainer plus equity) below the median market practices of the utility and broader industry peer groups. Based on this assessment, the Nominating, Governance and Corporate Responsibility Committee recommended and the Board approved an increase in the equity portion of outside director annual compensation in the amount of $20,000, effective January 1, 2020.

For 2019,2020, the pay components for non-employee Directors were: | Annual cash retainers | | | | | Cash retainer | | $ | 110,000 | | Additional cash retainer if serving as the Lead Independent Director of the Board | | $ | 30,000 | | Additional cash retainer if serving as a chair of a standing committee of the Board | | $ | 20,000 | | Additional cash retainer if served on the Business Security Subcommittee of the Operations, | | $ | 12,500 | | Environmental and Safety Committee (until May 22, 2019)(1) | | | | | Annual equity grant | | | | | In deferred common stock units until Board membership ends | | $ | 140,000 | | Meeting fees | | | | | Meeting fees are not paid for participation in a meeting of the Board | | | — | | Meeting fees are not paid for participation in a meeting of a committee or subcommittee of the Board | | | — |

(1) | The Business Security and Resiliency Committee was established as a standing committee of the Board in July 2019. |

| Annual cash retainers | | | | | Cash retainer | | $ | 110,000 | | Additional cash retainer if serving as the Lead Independent Director of the Board | | $ | 30,000 | | Additional cash retainer if serving as a chair of a standing committee of the Board | | $ | 20,000 | | Annual equity grant | | | | | In deferred common stock units until Board membership ends | | $ | 160,000 | | Meeting fees | | | | | Meeting fees are not paid for participation in a meeting of the Board | | | — | | Meeting fees are not paid for participation in a meeting of a committee or subcommittee of the Board | | | — |

Director Compensation Table The following table reports compensation to the non-employee Directors during 2019. Ms. Hagen retired from our Board in May 2019.2020. | Name | | Fees Earned or

Paid in Cash

($)(1) | | Stock Awards

($)(2) | | All Other

Compensation

($)(3) | | Total

($) | | Fees Earned or

Paid in Cash

($)(1) | | Stock Awards

($)(2) | | All Other

Compensation

($)(3) | | Total

($) | | Janaki Akella | | 116,250 | | 140,000 | | 0 | | 256,250 | | 110,000 | | 160,000 | | 0 | | 270,000 | | Juanita Powell Baranco | | 110,000 | | 140,000 | | 0 | | 250,000 | | 110,000 | | 160,000 | | 0 | | 270,000 | | Jon A. Boscia | | 121,667 | | 140,000 | | 0 | | 261,667 | | 130,000 | | 160,000 | | 0 | | 290,000 | | Henry A. Clark III | | 110,000 | | 140,000 | | 0 | | 250,000 | | 110,000 | | 160,000 | | 0 | | 270,000 | | Anthony F. Earley, Jr. | | 110,000 | | 140,000 | | 0 | | 250,000 | | 110,000 | | 160,000 | | 0 | | 270,000 | | David J. Grain | | 130,000 | | 140,000 | | 0 | | 270,000 | | 130,000 | | 160,000 | | 0 | | 290,000 | | Veronica M. Hagen | | 45,833 | | 58,333 | | 0 | | 104,167 | | | Colette D. Honorable(4) | | | 0 | | 0 | | 0 | | 0 | | Donald M. James | | 110,000 | | 140,000 | | 0 | | 250,000 | | 110,000 | | 160,000 | | 0 | | 270,000 | | John D. Johns | | 130,000 | | 140,000 | | 0 | | 270,000 | | 130,000 | | 160,000 | | 0 | | 290,000 | | Dale E. Klein | | 127,917 | | 140,000 | | 0 | | 267,917 | | 130,000 | | 160,000 | | 0 | | 290,000 | | Ernest J. Moniz | | 127,917 | | 140,000 | | 0 | | 267,917 | | 130,000 | | 160,000 | | 0 | | 290,000 | | William G. Smith, Jr. | | 130,000 | | 140,000 | | 0 | | 270,000 | | 130,000 | | 160,000 | | 0 | | 290,000 | | Steven R. Specker | | 150,000 | | 140,000 | | 0 | | 290,000 | | 140,000 | | 160,000 | | 0 | | 300,000 | Larry D. Thompson | | 120,000 | | 140,000 | | 0 | | 260,000 | | 55,000 | | 80,000 | | 0 | | 135,000 | | E. Jenner Wood III | | 110,000 | | 140,000 | | 0 | | 250,000 | | 110,000 | | 160,000 | | 0 | | 270,000 |

| (1) | Includes amounts voluntarily deferred in the Director Deferred Compensation Plan. | | (2) | Represents the grant date fair market value of deferred common stock units. |

Table of Contents Corporate Governance at Southern Company

45 | (3) | No non-employee Director of the Company received perquisites in an amount above the reporting threshold. |

40 (4) | Southern CompanyMs. Honorable was elected to the Board in October 2020 Proxy Statementand received compensation starting in January 2021. | | (5) | Mr. Thompson retired from our Board in May 2020. |

Table of Contents

Corporate Governance at Southern Company

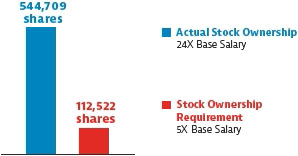

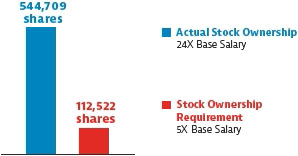

Director Stock Ownership Guidelines Under our Corporate Governance Guidelines, non-employee Directors are required to beneficially own, within five years of their initial election to the Board, common stock of the Company equal to at least five times the annual cash retainer. The annual equity grant for non-employee Directors is required to be deferred until Board membership ends.All non-employee Directors either meet the stock ownership guideline or are expected to meet the guideline within the allowed timeframe. Director Deferred Compensation Plan The annual equity grant to the independent Directors is required to be deferred in shares of common stock. The shares are not distributed until membership on the Board ends. The deferral is made under the Director Deferred Compensation Plan and invested in common stock units which earn dividends as if invested in common stock. Earnings are reinvested in additional stock units. Upon leaving the Board, distributions are made in common stock or cash. In addition, Directors may elect to defer up to 100% of their remaining compensation in the Director Deferred Compensation Plan until membership on the Board ends. Such deferred compensation may be invested as follows, at the Director’s election: | ► | in common stock units which earn dividends as if invested in common stock and are distributed in shares of common stock or cash upon leaving the Board; or | | ► | at the prime interest rate which is paid in cash upon leaving the Board. |

All investments and earnings in the Director Deferred Compensation Plan are fully vested and, at the election of the Director, may be distributed in a lump-sum payment, or in up to 10 annual distributions after leaving the Board. We have established a grantor trust that primarily holds common stock that funds the common stock units that are distributed in shares of common stock. Directors have voting rights in the shares held in the trust attributable to these units. Southern Company 2020 Proxy Statement | 41 |

Table of Contents 46 Compensation Discussion and Analysis  | | Compensation Discussion and Analysis |

What you will find in this CD&A:

New or notable in this year’s CD&A Enhancements:&A: | ► | Strategic AlignmentThis CD&A focuses on the compensation for our CEO, CFO and our three other most highly compensated executive officers serving at the end of ESG Matters:Enhanced discussion on how we link our compensation program design2020. Collectively, these officers are referred to our strategy on key ESG matters, including an update on progress towardsas the GHG emission reduction goal for the CEO’s 2019-2021 long-term incentive program

NEOs. |

42 | Southern Company 2020 Proxy Statement |

Table of Contents Compensation Discussion and Analysis

47  |  | CD&A At-a-Glance | |

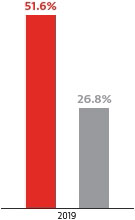

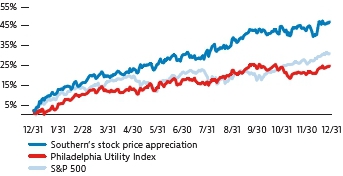

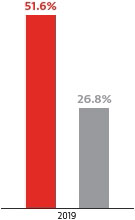

KEY 2019 COMPANY HIGHLIGHTSKey 2020 Company Highlights | 51.6%Outstanding response and resiliency

Total Shareholder Return

Over$2.5billion

in dividends to stockholdersduring unprecedented times

| | More than$20billionBest in class customer service

increase in market capitalizationreflecting excellent operational reliability throughout the year

| ReachedAdjusted EPS exceeded

guidance range

| | Completed major milestones

on Plant Vogtle construction project | | Adjusted EPS exceeded13.64%

guidance range

Total Shareholder Return over the last 3constructive rate

case outcomes years | | 72Focus on our employees

to keep them healthy and safe and promote a diverse, inclusive and innovative culture

| Net zero by 2050

updated long-term GHG reduction goal | | $2.7 billion

in dividends to stockholders | 73 consecutive years

of dividends paid |

| 1819 consecutive years

of dividend increases

|

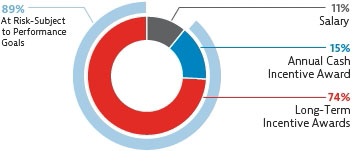

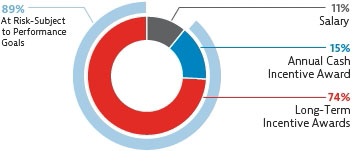

Our Compensation BeliefsFocus

In 2020, we faced a global health pandemic, an economic downturn and social and political unrest that impacted our communities and our nation. Throughout the year, a top priority was to keep our employees healthy and safe while maintaining the Southern Company system’s critical operations. | ► | In 2019, we continued to focus on ensuring that ourWe closely monitored the compensation program, is designedincluding incentive compensation metrics and implementedgoals set for 2020 to drivehelp ensure that they balanced the demands of the pandemic and appropriately recognized 2020 performance and long-term value creation for our stockholders and reflectsreflected feedback from our ongoing stockholder engagement program. We did not make any adjustments or changes to the incentive compensation metrics, goals and targets we set for the year. | | ► | We continue to target the total direct compensation for our executives at market median and place a very significant portion of that target compensation at risk. For our CEO, 91% of pay is at risk. This approach helps ensure management accountability to deliver on our annual and long-term commitments to stockholders. | | ► | The Committee exercises discretion when necessary to appropriately align payouts with business performance and stockholder returns. In 2020 as well as prior years, this has resulted in exercising negative discretion to reflect charges against earnings resulting from large construction projects and excluding large gains from asset dispositions that were not included in our annual financial plans. | | ► | The Committee continues to believe that the majority of executive pay should be focused on long-term incentives. In 2020, 74% of the CEO’s target pay was comprised of long-term awards based on multi-year achievement of financial goals, stock price performance and the Company’s GHG goals. | | ► | Our compensation program is designed to support our human capital strategy of investing in our employees to attract, engage, competitively compensate and retain key talent and reinforce our pay for performance philosophy. | ► | We target the total direct compensation forenhanced our executives at market medianpay equity analysis and place a very significant portion of that target compensation at risk. For our CEO, 89% of pay is at risk. This approach helps ensure management accountability to deliver on our annualdiversity, equity and long-term commitments to stockholders.inclusion and talent development efforts during 2020. |

Table of Contents Southern Company 2021 Proxy Statement

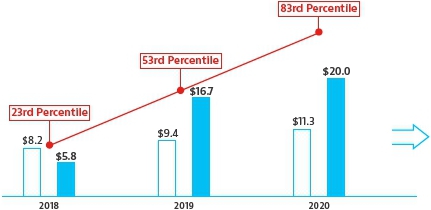

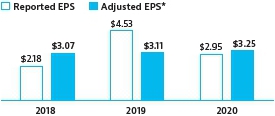

Key Company Performance Metrics

We delivered exceptionally strong financial, operational and stock price performance in 2019. Exceededour 2019 adjusted EPS goal | | Target

$3.04 | | Result

$3.11 | | Payout

154% | Exceededour 2019 operational goals, including safety, customer satisfaction and reliability | | Target

Various | | Result

Well

above

target | | Payout

175% | Exceededour peers on the three-year TSR goal* | | Target

Median | | Result

Above

median | | Payout

108% |

* | Peers are described onpage 62. |

Compensation Decisions for the CEO48

► | The CEO’s incentive compensation for 2019 reflects meaningful outperformance against the metrics and targets set by the Committee at the beginning of the applicable performance period. | ► | Consistent with prior years, the Committee evaluated each earnings adjustment, both positive and negative, and decided to pay on adjusted EPS for both the short-term and long-term incentive programs. For 2019, paying on adjusted EPS excluded, among other items, the $1.3 billion gain from the sale of Gulf Power. |

| | | | | | | | | | Key Company

Performance Metrics | | | Compensation Decisions for the CEO ►The CEO’s outstanding leadership was integral to navigating the Company through the many challenges of 2020, including a global pandemic, economic downturn, significant social and political unrest and an exceedingly busy storm season. The CEO was also instrumental in the continued advancement of our long-term strategy, including setting our updated goal to achieve net zero GHG emissions by 2050. ►The Company demonstrated substantial resilience in 2020, providing excellent operational reliability, delivering outstanding service to customers and achieving strong financial performance while working to keep our employees and customers safe. Calculated incentive compensation payouts for 2020 reflect our strong performance. ►Consistent with prior years, the Committee evaluated each earnings adjustment, both positive and negative, in determining final payouts with the objective of aligning pay with stockholder interests and being responsive to stockholder feedback. ►The CEO’s leadership through the pandemic was critical to continued progress at the Vogtle construction site during 2020, though increases in the project’s cost reserve resulted in charges against earnings for 2020. ►Consistent with its objective of aligning pay with stockholder interests as well as past practices, the Committee applied negative discretion to reduce the calculated 2020 incentive payouts for the CEO by approximately $2.5 million, which is equivalent to paying on GAAP for this item. ►The 2020 annual incentive award (PPP) payout (calculated at 170% of target) was reduced by $1.8 million or 41%, equivalent to a payout at target. A consistent approach was applied to the 2018-2020 long-term incentive award (PSP) payout. | | | We delivered exceptionally strong financial, operational and stock price performance in 2020 despite the challenging year. | | | | | Exceeded our 2020 EPS goal | | | | | Target | | Result | | Payout | | | | | $3.16 | | $3.25 | | 166% | | | | | Exceeded our 2020 operational goals, including safety, customer satisfaction and reliability | | | | | Target | | Result | | Payout | | | | | Various | | Well

above

target | | 160% | | | | | Exceeded our peer group on the three-year

TSR goal | | | | | Target | | Result | | Payout | | | | | Median | | Top

quartile | | 183% | | | | | | | | | | | | | | |

2019 Performance

Pay Program | | 172%

Achievement | 2017-2019 Performance

Share Program | | 134%

Achievement |

Responsiveness to Ongoing Stockholder Engagement and Feedbackpage 4753 ► | ► | AddedMonitored developments during the year to help ensure that compensation plan design and previously-approved incentive goals and metrics continued to appropriately incentivize employees. | | ► | Continued to review all adjustments to earnings, whether positive or negative, to determine their appropriateness based on management control, materiality and overall impact to investors. | | ► | Continued to include a GHG emission reduction goal toin the CEO’s 2019-2021 long-term incentive award, and continuedenhanced disclosure of factors considered by the goal for the 2020-2022 performance period.Committee in its qualitative assessment. | | ► | Committed to disclose aggregated EEO-1 workforce diversity data beginning in 2021. | | ► | Enhanced our disclosurefocus on the goal rigortalent development and goal setting process undertaken by the Committee. | ► | Enhanced our disclosure on howdiversity, equity and inclusion efforts, including engaging an outside expert to audit our annual incentive award aligns with our ESG efforts and human capital beliefs.pay equity review process. |

Goal Rigor and Goal Setting Processpage 4956 ► | ► | The goal setting process used by the Committee aims to align goals with the Company’s financial plan and EPS guidance and include the appropriate level of stretch in the goals to encourage management to deliver and/or exceed on commitments to stockholders. |

Annual Change in Pension Valuepage 59

► | Increase in annual pension value is not due to any modification of the existing pension plan or formula and is primarily driven by macroeconomic factors such as low interest rates. |

Southern Company 2020 Proxy Statement | 43 |

Table of Contents Compensation Discussion and Analysis49

Letter from the Compensation and Management Succession Committee To our Fellow Stockholders: Over the last year, the challenges of the COVID-19 pandemic have significantly affected our employees, our customers and the communities we serve. At the same time, 2020 marked a year of significant progress for Southern Company and demonstrated the resilience of our workforce. As highlighted inUnder the 2019 Company Performance Overview onpage 4,Southern Companyachieved numerous successes on multiple fronts over the past year. Under thesteadfast leadership of our Chairman and CEO Tom Fanning, the Company had some of its strongestdemonstrated strong operational performance, delivered outstanding financial results (on an adjusted basis) and operational performances in recent history. The Company’smaintained positive TSR performance for 2019 was double that of the Philadelphia Utility Index. We made great stridesthrough a volatile year. Major milestones were achieved in 2019 on our construction project2020 at Georgia Power’s Plant Vogtle UnitsUnit 3 and 4 meeting all major milestones construction project. See page 3 for 2019.the 2020 Company performance overview.

During 2019, the Committee continued to focus on ensuring that our compensation programs are designed and implemented to drive long-term value creation for our stockholders, reflect feedback from our ongoing stockholder engagement program and are aligned with our compensation beliefs.

Compensation Committee Oversight and Engagement Throughout the year, our Committee remained focused on employee health and well-being and, with the rest of the Board, in overseeing the different business impacts and risks the pandemic, the economic downturn and the social and political unrest created. In 2019, we continued to beWe remained actively engaged in our oversight responsibilities for executive compensation, leadership development and management succession planning.through a pivot to virtual meetings beginning in March 2020. We met 10seven times in 2019,2020, with average Director attendance of 95%97%. We also discussed compensation and executive succession matters in many additional Board calls throughout the year.

The five independent Directors serving on the Compensationour Committee bring a diverse range of qualifications, attributes, skills, experiences and perspectives to our decision-making. We are committed to aligning pay with performance each year, hiring, developing and retaining topa diverse pool of talent and ensuringpromoting alignment of our compensation program with the Company’s long-term strategy.strategy and stockholders’ expectations. Throughout 20192020 and into 2020,2021, we continued our involvement in stockholder outreach, which includes independent Director participation in key engagements. In addition to direct participation, Directors receive regular updates from management on our robust stockholder engagement program. Key Focus Areas

An overview of the key focus areas for our Committee over the past year are described below. Managing Through the Pandemic | ► | A top priority remained workforce health and safety. The Company’s management acted swiftly to address safe business practices for our essential workers and facilitate a transition to remote working for more than half our employees so that critical business operations continued with the reliability our customers have come to expect. | | ► | We monitored the evolving external landscape and evaluated whether the compensation plan design and the previously-approved incentive goals and metrics continued to appropriately incentivize the employee workforce, including the executive team. Despite the challenges of 2020, we did not make any adjustments or changes to the incentive compensation metrics, goals and targets we set for the year. We also did not reduce our employee workforce or reduce pay for our broader workforce as a result of the coronavirus pandemic. |

Enhancing Human Capital Management Practices | ► | Our employees are one of our greatest assets, and our actions demonstrate the value we place on our people. We continued to invest in the well-being of our employees through a comprehensive total rewards strategy that includes competitive salary, annual incentive awards for nearly all employees and health, welfare and retirement benefits designed to encourage physical, financial and emotional/social well-being. | | ► | Our Values support our longstanding commitment to pay equity for all employees. Pay equity has always been an important component of our compensation program. Historically, the Company has conducted an annual internal compensation equity review. In 2020, we engaged an independent third party to audit our pay equity practices and annual review process. | | ► | Racism has no place in our company and our communities. We, along with the other Directors, oversaw the introduction by the CEO and his leadership team of a 4-stage approach to enhance Company efforts to promote racial equality in our workforce and the communities we serve. | | ► | We supported the Company’s commitment to provide additional transparency through disclosure of aggregated EEO-1 workforce diversity data beginning in 2021. |

Table of Contents Southern Company 2021 Proxy Statement

50 | ► | We continued quarterly engagement with management on key talent at the local business unit or operating company level, including their specific human resources initiatives and actions on diversity, equity and inclusion; pay equity, culture and employee attraction; engagement; and retention efforts. |

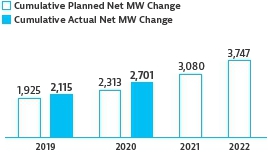

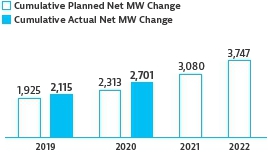

Developing Compensation Metrics to Support GHG Reduction Goals and Sustainable Business Practices | ► | We continued to align a meaningful portion of the CEO’s long-term equity incentive award to the Company’s 2030 and 2050 GHG emission reduction goals with a quantitative metric that measures performance over a three-year period in terms of net megawatt change (adding zero-carbon megawatts and eliminating coal or gas steam megawatts) and a qualitative modifier that assesses the CEO’s leadership in advancing the energy portfolio of the future. In response to stockholder feedback, we have enhanced disclosure of the factors considered by our Committee in our qualitative assessment. | | ► | We continued to include operational metrics in the annual incentive award that include safety, workforce diversity, supplier diversity, customer satisfaction and other measures that support our sustainable business model. |

Evaluating Compensation Plan Design and Alignment with Business Strategy and Stockholder Interests | ► | We conducted our annual rigorous program evaluation to assess whether our incentive plan design strikes the right balance between short- and long-term results and is aligned with business strategy, key financial objectives and stockholder interests. | | ► | We continue to believe the plan design works as intended and aligns CEO performance with the long-term strategy of our business and value creation for stockholders through performance metrics that focus on both: |

| — | outcome-based measures that create stockholder value on a risk-adjusted basis, such as relative TSR, ROE and adjusted EPS growth, and | | — | input measures intended to enhance the sustainability of our business strategy and create long-term value for our stockholders, such as GHG reduction, safety, customer satisfaction and culture. |

| ► | Our Committee continued actively engaging in assessing goal rigor and reviewing all earnings adjustments, both positive and negative, in making payout decisions by considering (1) management’s control over the item, (2) whether the item was contemplated in the financial plan, (3) alignment of pay outcome with stockholder impact and (4) alignment of pay outcome with management accountability. |

Conducting a CEO Performance Assessment | ► | We reviewed and approved the CEO’s performance goals for 20192020 and engaged in ongoing performance assessment dialogue throughout the year. | | ► | Utilizing an independent third-party, we facilitated a CEO performance review with the independent members of the Board. Details on CEO performance are onpage 5260. |

Compensation Plan Design and Alignment with Business Strategy and Stockholder InterestsSuccession Planning

| ► | We conductedThe challenging events of 2020 further reinforced the importance of our annual rigorous program evaluation to assess:thorough succession planning process for senior management and the CEO and the need for a robust talent pipeline that can provide the same steadfast leadership in challenging times. In 2020, our Committee: |

| — | Appropriateness of our incentive plan design to ensure that it strikesmet and discussed senior leadership talent and the right balance between short- and long-term resultsoverall company-wide talent management process throughout the year, | | — | Alignmentfacilitated regular exposure, through Board meetings and other opportunities, to high potential employees despite the remote nature of our incentive plan design with the business strategythese interactions throughout much of 2020, and key financial objectives of superior risk-adjusted total shareholder return and regular, predictable, sustainable EPS and dividend growth, while maintaining financial integrity | | — | Alignment with stockholder interests |

► | Conclusion: We believe our plan design works as intended and aligns CEO performancetogether with the long-term strategyLead Independent Director and the rest of our businessthe Board, regularly discussed and value creation for stockholders. | ► | For 2019, the Committee continued to uphold our philosophy of paying on adjusted earnings, excluding the $1.3 billion gain from the sale of Gulf Power, among other items, in the calculation of payouts under the short- and long-term incentive plans. The Committee will continue to be actively engaged in reviewing all earnings adjustments and, if needed, apply discretion to align pay with performance. |

Goal Setting and Earnings Adjustments

► | We reviewed, assessed and continued our practice of setting financial goals consistent with earnings guidance and our financial plan. | ► | We remained actively engaged in reviewing any EPS adjustment by considering (1) management’s control over the item, (2) whether the item was contemplated in the financial plan, (3) alignment of pay outcome with stockholder impact and (4) alignment of pay outcome with management accountability. | ► | Our policy is to pay on adjusted earnings and apply discretion, either positive or negative, if needed to align pay with performance. |

Human Capital Engagement

► | Our employees are one of our greatest assets, and our actions demonstrate the value we place on our people. We are fully committed toreassessed both the long-term value that is created by attracting, developing, |

44 | Southern Company 2020 Proxy Statementsuccession plan and emergency succession plan for the CEO and senior management. |